What does Incoterms mean?

There are many information on the internet on Incoterms. Many of the web pages use many industrial related terms which may not be familiar to many people. Here we try to help you understand what Incoterms refer to.

How did Incoterms come about?

International Commercial Terms (Incoterms) is commonly heard of and used today especially now that global trading is so common. How was it actually developed? When trading initially started, there was no standard definition of when the seller’s or the buyer’s obligations start or end. This lead to many discrepancies and disputes of the liability. There is confusion on who is liable for the shipment’s transit from the seller’s location to the buyer’s location.

History of Incoterms

International Chamber of Commerce (ICC) was setup to explore the understanding of trade terms. This helps to facilitate international trade in the 1920s. It started with an initial 6 common trade terms used by 13 different countries in 1923. The current latest version (Incoterms 2010) consists of 11 trade terms widely used worldwide. We have come a long way in making international trading a more pleasant one. The changes over the years were necessary to follow the logistical developments with technological developments and time. With the current set of Incoterms, both the seller and the buyer are clearly informed of their own obligations in the trade. This in turn helps in avoiding unnecessary international trade disputes. There are already plans for the next revision for Incoterms 2020. Incoterms 2010 is commonly and widely accepted. There are also other trade terms like Uniform Commercial Code (UCC) commonly used in the States.

What is Incoterms

Freight Incoterms are the standard contract term used in sales contracts with importing or exporting across country borders. This helps to define responsibility and liability for shipment of the goods. Simply, it states clearly how far along the shipment process will the supplier ensure that the goods are moved. It also states clearly at what point does the buyer take over the shipment process.

As a general rule of thumb, sellers should avoid terms that include the delivery, customs, taxes and duties at the destination. If the destination is a place that the seller is familiar with, then it poses no issue. However if this location is new and unfamiliar grounds, sellers may incur unexpected costs and delays. This may upset the buyers and even make that sale a loss. Buyers, on the other hand, should avoid terms that include collection, customs, taxes and duties at the origin for the same reasons.

Once both parties agreed to the Incoterms for the trade, the seller must ensure the following:-

- that the price quoted covers the responsibilities under that term

- the legal point of delivery must be clear

- there are no issues to cover all the costs to deliver to that point

- responsibility risks are clear and there are adequate coverage in terms of insurance for damages etc

- appropriate Incoterms is used for the agreed type of transport used or intended to be used to avoid disputes and indeterminable costs and risks.

Limitations of Incoterms

Having said the above, it is important to note that Incoterms assist sales contract. It helps in defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer. It does not constitute contract or govern law. Also it does not define where titles transfer. It certainly does not address the price payable, payment method, currency or credit items. Incoterms do not address all conditions of the sale. Incoterms do not identify the quality and quantity of goods being sold.

The exact documents that must be provided by the seller to the buyer to facilitate the customs clearance process at the buyer’s country is also not stated. It does not address liability for the failure to provide the goods in conformity with the contract of sale, delayed delivery, nor dispute resolution mechanisms. All parties involved in any contract should make sure all the applicable instances are addressed and agreed before signing the contract. Many legal matters can arise due to working only with Incoterms due to its limitations.

The Incoterms rules are accepted by governments, legal authorities, and practitioners worldwide for the interpretation of most commonly used terms in international trade. They are intended to reduce or remove altogether uncertainties arising from different interpretation of the rules in different countries.

What are the different rules in Incoterms 2010?

Rules for any mode of transport

EXW – Ex Works (named place of delivery)

This Incoterms (delivery term) means that the Seller is responsible only for making the goods available at his designated premises for pick up by the buyer or buyer’s designated transportation carrier. Do note that the seller is not responsible for loading the goods on the vehicle provided by the buyer unless otherwise agreed. Upon release of the goods to the buyer or carrier, the seller has no further responsibilities. All costs and risks of transportation transfer to the buyer. Variations on the this term ex works include ex factory, ex mill, ex plant, ex refinery, ex site, ex warehouse, etc.. This depends upon the type of origin facility at which goods will be delivered to the buyer by the seller.

This term places the maximum obligation on the buyer and minimum obligations on the seller. The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included. In common practice the buyer arranges the collection of the freight from the designated location. This includes the responsibility for clearing the goods through Customs. The buyer is also responsible for completing all the export documentation. The seller does have an obligation to obtain information and documents at the buyer’s request and cost. For EXW shipment, the buyer is under no obligation to provide such proof to the seller, or indeed to even export the goods.

A simplified illustration is as below for both air and sea freight arrangements.

FCA – Free Carrier (named place of delivery)

This term has been designed to meet the requirements of multi-modal transport, such as container or roll-on, roll-off traffic by trailers and ferries. It is based on the same name principle as F.O.B. (free on board). The seller fulfills its obligations when the goods are delivered, cleared for export, at a named place (possibly including the seller’s own premises). The goods can be delivered to a carrier nominated by the buyer, or to another party nominated by the buyer.

If delivery occurs at the seller’s premises, or at any other location that is under the seller’s control, the seller is responsible for loading the goods on to the buyer’s carrier. However, if delivery occurs at any other place, the seller is deemed to have delivered the goods once their transport has arrived at the named place. The buyer is responsible for both unloading the goods and loading them onto their own carrier.

If no precise point can be named at the time of the contract of sale, the parties should refer to the place where the carrier should take the goods into its charge. The risk of loss or damage to the goods is transferred from seller to buyer at that time and not at the ship’s rail. The term “carrier” means any person by whom or in whose name a contract of carriage by road, rail, air, sea, or a combination of modes has been made. When a seller has been furnished a bill of lading, way bill or carrier’s receipt, the seller duly fulfills its obligation by presenting such a document issued by a carrier.

A simplified illustration is as below for both air and sea freight arrangements.

CPT – Carriage Paid To (named place of destination)

CPT replaces the C&F (cost and freight) and CFR terms for all shipping modes outside of non-containerized sea freight. This term means that the seller pays for the carriage of the goods up to the named place of destination. The goods are considered to be delivered when the goods have been handed over to the first or main carrier. Hence, the risk transfers to buyer upon handing goods over to that carrier at the place of shipment in the country of Export.

The seller is responsible for origin costs including export clearance and freight costs for carriage to the named place of destination. The final destination can be the buyer’s facilities or a port of destination. This has to be mutually agreed by seller and buyer. Insurance is not included as the seller’s responsibility under this term.

A simplified illustration is as below for both air and sea freight arrangements.

CIP – Carriage and Insurance Paid to (named place of destination)

This term is broadly similar to the above CPT term. The exception is that the seller is required to obtain insurance for the goods while in transit. CIP requires the seller to insure the goods for 110% of the contract value. The minimum insurance coverage is the Institute Cargo Clauses of the Institute of London Underwriters (which would be Institute Cargo Clauses (C)), or any similar set of clauses. The policy should be in the same currency as the contract. It should allow the buyer, the seller, and anyone else with an insurable interest in the goods to be able to make a claim.

A simplified illustration is as below for both air and sea freight arrangements.

DAT – Delivered At Terminal (named terminal at port or place of destination)

This term requires the seller delivers the goods, unloaded, at the named terminal. The seller covers all the costs of transport (export fees, carriage, unloading from main carrier at destination port and destination port charges). The seller assumes all risk until arrival at the destination port or terminal.

The terminal can be a Port, Airport, or inland freight interchange. It must be a facility with the capability to receive the shipment. All charges after unloading (for example, Import duty, taxes, customs and on-carriage) are to be borne by buyer. However, it is important to note that any delay or demurrage charges at the terminal will generally be for the seller’s account.

A simplified illustration is as below for land, air and sea freight arrangements.

DAP – Delivered At Place (named place of destination)

This term means that the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. Under DAP terms, the risk passes from seller to buyer from the point of destination mentioned in the contract of delivery. Once goods are ready for shipment, the necessary packing is carried out by the seller at his own cost. This is so that the goods reach their final destination safely. All necessary legal formalities in the exporting country are completed by the seller at his own cost and risk to clear the goods for export.

After arrival of the goods in the country of destination, the customs clearance in the importing country needs to be completed by the buyer at his own cost and risk, including all customs duties and taxes. However, as with DAT terms any delay or demurrage charges are to be borne by the seller. The necessary unloading cost at final destination has to be borne by buyer under DAP terms.

A simplified illustration is as below for shipment arrangements.

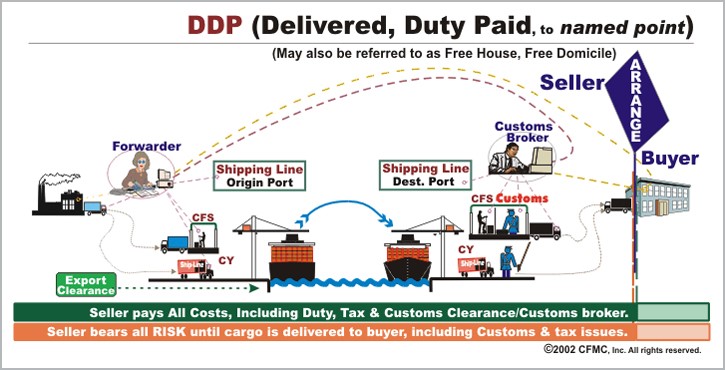

DDP – Delivered Duty Paid (named place of destination)

This term places the maximum obligations on the seller and minimum obligations on the buyer. Here, the seller is responsible for delivering the goods to the named place in the country of the buyer. The seller pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. No risk or responsibility is transferred to the buyer until delivery of the goods at the named place of destination. Unless the rules and regulations in the buyer’s country are very well understood, DDP terms can be a very big risk both in terms of delays and in unforeseen extra costs, and should be used with caution. Under DDP terms, the seller has no obligation to insure the shipment.

A simplified illustration is as below for shipment arrangements.

Rules for sea and inland waterway transport

The four rules defined by Incoterms 2010 for international trade where transportation is entirely conducted by water are as per the below. It is important to note that these terms are generally not suitable for shipments loaded in shipping containers.

FAS – Free Alongside Ship (named port of shipment)

The seller delivers when the goods are placed alongside the buyer’s vessel at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment. The FAS term requires the seller to clear the goods for export unless otherwise agreed and stated. Under FAS terms, the seller has no obligation to insure the shipment.

A simplified illustration is as below for shipment arrangements.

FOB – Free on Board (named port of shipment)

Under “F.O.B.” or “free on board,” the goods are placed on board the ship by the seller at a port of shipment named in the sales agreement. The risk of loss of or damage to the goods is transferred to the buyer when the goods pass the ship’s rail. This means off the dock and placed on the ship. The seller pays the cost of loading the goods. In this case, the seller must also arrange for export clearance. On the other hand, the buyer pays cost of marine freight transportation, bill of lading fees, insurance, unloading and transportation cost from the arrival port to destination. The seller is not responsible for costs of actually stowing the goods on board. However, the seller is responsible for that portion of the terminal charges which cover services other than stowage and vessel wharfage charges.

A simplified illustration is as below for shipment arrangements.

CFR – Cost and Freight (named port of destination)

The seller pays for the carriage of the goods up to the named port of destination. Risk transfers to buyer when the goods have been loaded on board the ship in the country of Export. The Shipper is responsible for origin costs including export clearance and freight costs for carriage to named port. The shipper is not responsible for delivery to the final destination from the port (generally the buyer’s facilities), or for buying insurance. The seller has fulfilled his obligation when he has tendered the goods to the transportation carrier. The carrier will under the contract of carriage, accomplish this transportation to the named point.

A simplified illustration is as below for shipment arrangements.

CIF – Cost, Insurance & Freight (named port of destination)

This term is broadly similar to the above CFR term. The exception is that the seller is required to obtain insurance for the goods while in transit to the named port of destination. CIF requires the seller to insure the goods for 110% of their value. The minimum coverage is of the Institute Cargo Clauses of the Institute of London Underwriters (which would be Institute Cargo Clauses (C)), or any similar set of clauses. The policy should be in the same currency as the contract. The seller must also turn over necessary documents to obtain the goods from the carrier. The documents needed to assert claim against an insurer to the buyer must also be made available.

A simplified illustration is as below for shipment arrangements.

Summary

Do feel free to write or contact us for your queries for your shipments.

With thanks! Valuable information!

Great that it helps you! Do write to us for any logistical queries.

I think this is among the most vital information for me. And i’m glad reading your article. But wanna remark on few general things, The website style is wonderful, the articles is really excellent : D. Good job, cheers

Thanks for your compliments. Do drop us any queries for your shipments.

Your means of telling the whole thing in this article is in fact good, all be able to easily understand it, Thanks a lot.

Thanks for your compliments 🙂

Very interesting info!Perfect just what I was looking for!

Thanks! Glad that our sharing helped you!

Excellent website you have right here, i do concur on some points nevertheless, but not all.

Thanks for your time in reading and viewing our website. We try our best to share our knowledge and experience in our field.